Frequently Asked Questions

about the Community Foundation for Northern Virginia

Below we have compiled some frequently asked questions of the Community Foundation Staff. We hope this is helpful, but if you would like to speak with our team directly, please contact us today.About Community Foundations and CFNOVA

A community foundation is a nonprofit organization that helps people, families, and businesses invest in the communities they care about. It brings together charitable resources, local knowledge, and long-term stewardship to address community needs and create lasting impact.

Founded in 1978, the Community Foundation for Northern Virginia serves the counties of Fairfax, Loudoun, Arlington and Prince William, and the cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park. We steward charitable funds, award grants and scholarships, provide research and community leadership, and connect generous people with local organizations working to address the region’s most pressing challenges. Our goal is to make Northern Virginia a thriving, inclusive community for everyone.

Since 1978, CFNOVA has invested more than $100 million to support education, health, housing, and other community priorities across Northern Virginia, working alongside donors, nonprofits, and civic leaders to strengthen our region. We know the region well, we study its needs, and we work with local leaders to find solutions. We also help donors make the biggest possible impact with their giving.

Our data and research center, Insight Region®, sets us apart. It is dedicated to understanding the unique needs, trends, and opportunities within Northern Virginia’s neighborhoods, towns, and cities—helping donors and partners make informed, effective decisions.

We are a 501(c)3 nonprofit organization, but while most charities focus on one issue, like hunger or housing, CFNOVA supports many different needs across Northern Virginia. We do this not only through our research, grants, and scholarships, but also through our partnerships with donors. Our donor funds are managed responsibly so your gifts make a long-term difference.

CFNOVA is a trusted charitable giving partner, and meets National Standards for U.S. Community Foundations, undergoes annual audits, and shares clear reports so donors can trust how funds are managed.

Funds & Giving Options

For a more detailed comparison of a donor-advised fund and a private foundation, click here.

A donor-established fund offers flexibility and benefits that direct gifts do not. You can donate complex gifts, such as appreciated assets, stock transfers, and QCD distributions, which smaller nonprofits may not be able to collect. Donors can make one contribution that supports multiple charities and take an immediate tax deduction while giving over time.

We can also facilitate collective giving and collective impact by inviting other donors to contribute to your fund – something that commercial gift funds and smaller nonprofits are not equipped to support.

Opening a fund with CFNOVA allows family involvement, creates a lasting legacy, and offers investment options to grow your charitable impact.

For more information on setting up a donor-advised fund, visit our Establish a Fund page.

Endowed funds are invested in CFNOVA’s pooled portfolio managed by Goldman Sachs. Non-endowed funds can also be invested upon request.

Grants & Scholarships

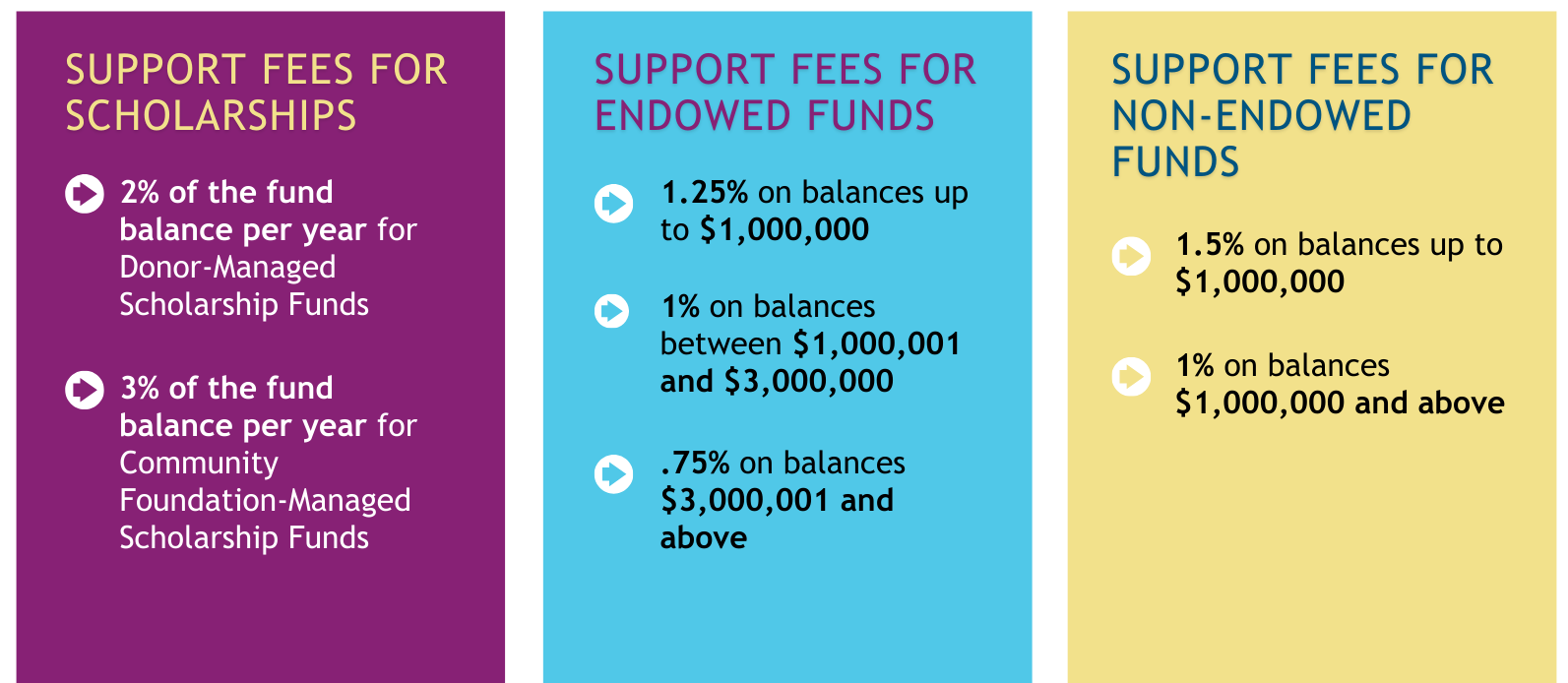

Fees & Minimums

- Permanent Funds, Designated Funds, and Donor-Advised Funds: $10,000

- Field-of-Interest Funds: $25,000

- Scholarship Funds:

- Donor-Managed: $50,000

- Foundation-Managed: $100,000

- Funds requesting a customized grantmaking strategy: $150,000–$200,000

- Externally Managed Funds: $250,000

(Starting January 1, 2026, these minimums ensure each fund can create meaningful impact over time.)

Donor Services & IRA Gifts

IRA gifts cannot go to donor advised funds, supporting organizations, or split-interest gifts like charitable trusts or annuities.

They can support CFNOVA’s general operations, the Permanent Fund for Northern Virginia, any field-of-interest fund (such as the Community Investment Funds, Environment Fund, or Ross-Roberts Fund for the Arts), Giving Circles, and designated funds that benefit specific nonprofits.