February 26, 2026

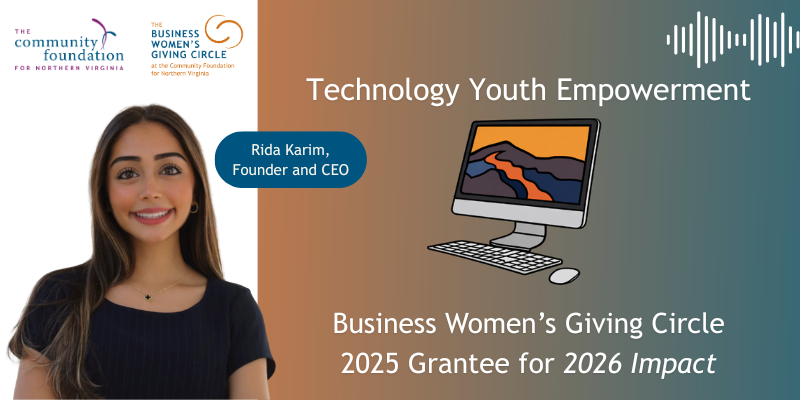

The

Business Women’s Giving Circle (BWGC), established at the

Community Foundation for Northern Virginia,

announced its 2025 grants—set to make impact in 2026—this past January. One of this year’s grantees is

Technology Youth Empowerment. The Community Foundation's Amanda Bomfim, recently sat down with their Founder and CEO, Rida Karim, to discuss how this grant will support and strengthen their work.

Read More

February 20, 2026

Effective December 24, 2025, the U.S. Postal Service has changed how it defines the official postmark date, which could impact the timing of when checks mailed to nonprofits “count” for IRS charitable deduction purposes. All of this adds up to an important opportunity to remind clients about the benefits of giving to their favorite charities in ways other than writing a check.

Read More

February 17, 2026

by David Mead, CIMA®, Managing Director, Wealth Management Advisor, Portfolio Manager, David Mead and Associates | Merrill Lynch Wealth Management

These tips from Merrill can help you pursue your goals and make the most of your financial plan.

You are doing all the right things, contributing to a 401(k), saving for your kids’ college, using debt strategically and more. But have you pulled all those pieces together into a real financial plan? One that considers unexpected life events, taxes, inflation and changing market conditions? One that projects the likelihood that you will reach your goals and suggests adjustments to help you overcome hurdles along the way?

Read More

February 11, 2026

The Community Foundation’s Resilient Communications: Cutting Through the Noise During Challenging Times webinar, offered through the Beyond the Grant series, was a great learning experience for 43 nonprofit leaders, seeking to strengthen their missions through more intentional storytelling and messaging. Participants learned that organizations that consistently prioritized effective communication and emotionally resonant stories were better equipped to deliver on their missions, inspire donors, and offer hope during challenging moments.

Read More

February 4, 2026

In this uplifting episode of the We’re Good Podcast, host Lee Ann Necessary Brownlee spotlights Community Foundation of Northern Virginia grantee, the Shepherd Center of Fairfax-Burke, a vital community organization helping older adults remain independent, connected, and safe. Joined by Shepherd’s Center Executive Director Beth Kilgore-Robinson and longtime volunteer and Board of Directors Vice-Chair Barry Wickersham, this heartfelt and fun conversation explores independence, purpose, human connection, and the quiet power of community-driven care—the kind of good that often goes unseen, but changes lives every day.

Read More

January 15, 2026

Sue Aft was known for her kindness, compassion, and unwavering commitment to helping others. Those who knew her saw firsthand the way she reached out to people in need and made them feel valued.

Her husband, Rabbi Bruce Aft, is determined to ensure that Sue’s impact continues long after her passing. “Sue’s legacy is her kindness and willingness to reach out to her students wherever they were and help them with whatever their needs were at any given time.”

Read More

January 7, 2026

In this uplifting episode of the We’re Good Podcast, host Lee Ann Necessary Brownlee spotlights a Community Foundation for Northern Virginia 2025 grantee, Girls on the Run of Northern Virginia — “much more than running” program blends movement with powerful life lessons for 3rd–8th grade girls. Jaimi Taylor and Sammy Carr reveal how the intentionally designed, evidence-based curriculum builds a “Go-To Toolbox” of social-emotional skills—star power, happy pace, breathe-and-reset—that girls carry far beyond the track. With research showing girls’ self-belief dips sharply around age nine, GOTR meets them right then, wrapping goal-setting, empathy, and voice-finding into games, journaling, and team rituals that make character feel fun—and stick.

Read More

January 6, 2026

The

Business Women’s Giving Circle (BWGC), established at the

Community Foundation for Northern Virginia, is proud to

award $70,000 in 2025 grants to five outstanding organizations delivering programs to girls and young women that provide STEM exposure and training along with leadership and entrepreneurship skills.

Read More

December 16, 2025

The Community Foundation for Northern Virginia and Community Foundation for Loudoun and Northern Fauquier Counties announce that the Loudoun Impact Fund and Creighton Gives, an initiative by Creighton Farms, have awarded $246,000 in grants to 29 local nonprofit organizations providing services to Loudoun residents in need. This marks a record-breaking year for the Loudoun Impact Fund.

Read More

December 11, 2025

As you guide your charitably inclined clients through

year-end planning, the Community Foundation for Northern Virginia is happy to help you navigate the unusually time-sensitive opportunities available in 2025. With major charitable deduction

changes taking effect in 2026 under the OBBBA, this year presents a critical window for optimizing both tax strategy and philanthropic impact.

Read More

Questions?

Questions? Questions?

Questions?